Introduction

The European Union’s updated Bioeconomy Strategy marks a significant shift in how materials, resources, and industrial value chains are expected to evolve over the next decade. As sustainability regulations tighten and circular economy goals accelerate, biodegradable and paper-based packaging has moved from a niche alternative to a strategic priority.

For packaging manufacturers, the strategy sends a clear signal: future competitiveness depends on renewable materials, traceable sourcing, and scalable production aligned with EU policy direction.

What Is the EU Bioeconomy Strategy?

The EU bioeconomy refers to the production of renewable biological resources and their conversion into value-added products such as food, bio-based materials, and packaging.

According to the European Commission, the bioeconomy already generates over €2 trillion in annual turnover and employs approximately 17 million people across the EU. The updated strategy focuses on three core pillars:

Scaling sustainable bio-based materials

Reducing dependence on fossil-based resources

Strengthening circular and regional supply chains

These priorities directly impact the future of paper packaging, molded fiber products, and compostable foodservice packaging.

Why Packaging Is a Key Beneficiary

Packaging sits at the intersection of regulation, consumer behavior, and industrial transition.

Under the EU’s bioeconomy framework, materials such as paperboard, molded fiber, agricultural residue fibers, and water-based barrier coatings are favored due to:

Renewable feedstock origins

Compatibility with recycling and composting systems

Lower lifecycle carbon footprint compared to plastics

As a result, paper packaging is no longer just a compliance choice—it is becoming a strategic growth material.

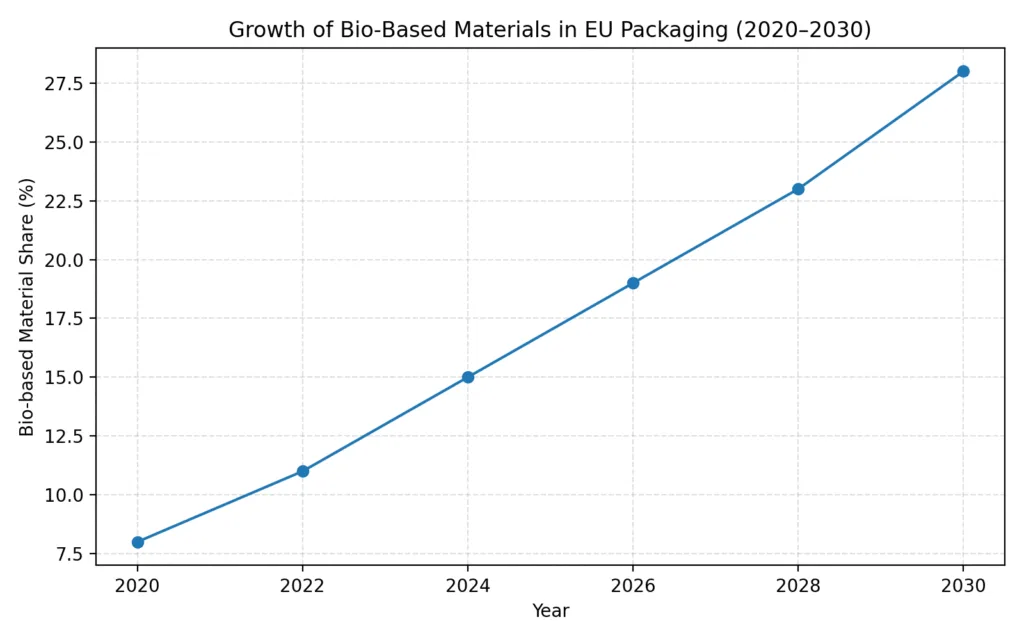

Data Insight: Bio-Based Materials on the Rise

Growth of Bio-Based Materials in EU Packaging (2020–2030)

2020: ~9% market share

2025 (est.): ~14%

2030 (forecast): ~20%+

Source: European Commission, Joint Research Centre (JRC), industry forecasts

This steady growth reflects both regulatory pressure and brand-driven sustainability commitments.

Implications for Paper & Biodegradable Packaging Manufacturers

The strategy reshapes expectations across the entire value chain:

1. Raw Material Selection Becomes Strategic

Manufacturers are encouraged to prioritize certified wood pulp, agricultural fibers, and responsibly sourced biomass, reducing exposure to fossil-based volatility.

2. Barrier Technology Matters More Than Ever

The EU emphasizes material recyclability and compostability, pushing innovation toward water-based and polymer-free barrier coatings rather than conventional plastic laminations.

3. Traceability and Transparency Are No Longer Optional

Future procurement decisions increasingly favor suppliers who can demonstrate:

Material origin

Lifecycle impact

Regulatory alignment across EU markets

From Policy to Market Reality

What makes the EU Bioeconomy Strategy particularly influential is its translation into downstream regulations, including:

Packaging and Packaging Waste Regulation (PPWR)

Extended Producer Responsibility (EPR) schemes

Green public procurement standards

Together, these frameworks accelerate demand for paper cups, food containers, and molded fiber packaging that meet both functional and sustainability benchmarks.

Strategic Opportunities for Manufacturers

For packaging suppliers, the strategy opens several concrete opportunities:

Replacing plastic-lined cups with recyclable paper alternatives

Expanding into aviation, rail, vending, and automated foodservice channels

Supporting brands seeking EU-compliant packaging for cross-border markets

Manufacturers that invest early in material innovation and process optimization are better positioned to capture long-term contracts with global foodservice and retail brands.

Conclusion: A Policy That Shapes the Next Decade

The EU’s bioeconomy strategy is more than a policy document—it is a roadmap for how materials will be sourced, processed, and evaluated in the future.

For biodegradable and paper packaging manufacturers, alignment with this strategy means relevance, resilience, and growth in a rapidly evolving global market.

At Tiptopak, we continue to develop paper-based food packaging solutions that support circular economy goals while meeting the practical demands of modern foodservice operations.